[CHAINIUM ICO]-REVOLUTIONIZING EQUITY MARKETS THROUGH BLOCKCHAIN TECHNOLOGY

Chainium

is an upcoming company that will apply the blockchain system to

revolutionize the equity markets around the world. Trading of stocks can

be said to have begun back in the 17th century with the Dutch East

India Company being the first company to have traded its shares for

capital. Traders feared expeditions to the West Indies during those

times. It was too risky to set sail and the cost incurred was high. The

company then offered their shares to investors to try and spread the

risk. This would raise the capital they required for the trip and make

it cheaper for investors to invest in the company. The first evidence of

dividends was also in this era as the company offered some form of

payback if the trading was successful. Speculations were also first

recorded here as people estimated the probable profits the company was

going to make form its expeditions. This resulted in a trade of their

shares in secondary markets. Secondary markets are where trading of

shares take place after the IPO has been conducted. The IPO is the

primary market where the participating company offers its shares. As the

trading of the Dutch East India Company stocks increased, there needed

to be a record that showed the transfer details of every stock traded in

the secondary market. This would help in tracing every share that the

company had offered. Registrars were used back then for this type of

work.

In as much as there have been positive changes in the stock market, there are some key areas that could still be changed to make the stock markets even more efficient. The system that is currently being used is an okay system but it could be better. What also fuels the need for this change is the fact that the current generation is not keen on stock markets as the previous one was. To them stock markets are not as transparent as they would want them to be and would rather invest in businesses directly rather than this channel. Recent studies have also shown a decline in the number of companies that go public since the early 2000’s. The financial crisis that was seen in 2008 is also an indicator that we need a new system that is able to show signs of a collapse early enough so that we may be able to come up with measures that will prevent them from happening.

The innovation that is blockchain can provide solutions to the problems facing the stock market. One of the key things that blockchain is praised for is the security it is able to offer. Blockchain records data in a ledger like format. Data can only be added in once a number of random users within a particular blockchain accept this data as legitimate. The data is stored across a network of computers. Blockchain decentralizes the data it has such that affecting one computer in the network will have no effect on the data stored across its decentralized network. Any change of data is also recorded such that manipulating data becomes very difficult as all involved parties will note the change and a record will be kept showing who tried to change the data. Chainium is basing its system on blockchain. It will use the Ethereum blockchain. The Ethereum blockchain has a feature that allows developers to create smart contracts. Smart contracts are a set of agreements set by two or more trading parties where requirements are placed concerning the transactions. The trade can only take place once all parties meet this requirement. Blockchain technology has been applied in many fields and the stock market could prove to be the most important one yet.

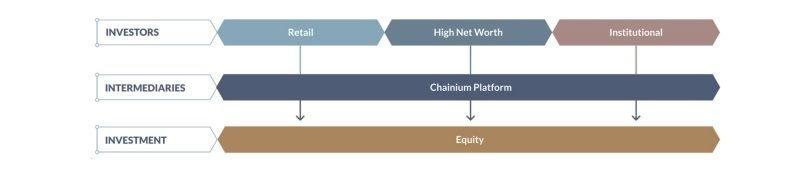

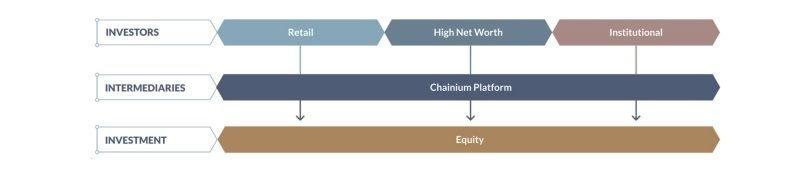

Chainium wants to return the stock market back to its basics, the need to raise capital for business and provide a platform for investments. Chainium is seeking to create a platform where companies seeking to raise capital and investors seeking for good opportunities to invest in are brought together. In its platform, these two parties will be trading on a one on one basis; the business owner and the prospective investor. Chainium took this approach as many businesses in the 21st century are opting for other forms of investments rather than going public. There are so many requirements and bureaucracies that are involved when a company decides to go public. It is even harder for smaller companies as they may not have the capital itself needed to go public. They therefore opt for angel investors, venture capitalists or borrow loans from their friends and family as it is much simpler in this way. The disadvantage with opting for any of these options is the fact that business owners will have to bend to the demands of the investor which may sometimes hurt their business plans. With the Chainium system, business owners will be linked directly to investors who are willing to invest in viable opportunities. The great thing about this system is that it will work similarly to an IPO in that the power of negotiation lies with the business owner. The business owner will only accept offers that will help the business grow.

Furthermore, a one on one system will also eliminate the use of middlemen in equity markets. In as much as they are effective, they also come with cost implications for both trading parties. Companies and investors have also suffered in the hands of some of these stock brokers as they collude with other parties to swindle fortunes out of their stocks. Insider trading and other types of fraud will have been eradicated using this system. There is also the potential of saving a huge amount of money that would have otherwise been used in servicing frictional costs.

The dangers that come with speculation can also be done away with using the Chainium platform. The 2008 economic recession that hit the world was caused by a lot of speculation within different market sectors. Speculators were predicting growth in the housing industry which led most investors to invest their money in numerous housing companies. Developers also took bank loans to develop housing complexes as the people took more loans to buy houses and cars. This speculation led to a chain of loans that the analysts predicted the economy could not sustain and when these signs started showing investors started pulling out their money. Loans were left unpaid as investors scrambled out of the market opting to save some money while they still can. The rush in selling of stocks caused a collapse in prices which greatly affected the stock market. This happened in the United States but since investors come from various parts of the world and the US markets supports many economies, the effect was felt worldwide. This happened because the current equity market structure is not as transparent as it should be. Chainium is offering transparency through its platform. The personal approach to business will help investors and business owners discuss growth and challenges facing growth which could help settle investors in case of any circulating rumors. Business owners will have the chance to assure investors of their plans to avert any foreseeable crisis. This will keep investors calm and willing to keep their money invested in these stocks.

The problem with business valuation can be done away with in the Chainium platform. The 2000’s and 2010’s have seen quite the boom in technological companies and most successful ones have gone public; the values of companies such as Facebook or amazon are investor dreams. These are the type of companies anyone would want to put their money into. The problem that arose with the popularity of tech companies is their over valuation. Many startups are coming up and going public. Investors pump in a lot of money into these startups hoping that they will bear even half the fruit that Facebook or amazon bore. These startups however offer little innovation. Most of the niches they occupy have inadequate market numbers that investors would want to see. The existing tech companies also end up adopting their innovation thus making them obsolete. The best-case scenarios for startups are being absorbed by the established tech companies which would be good for investors. Analysts are speculating that in a few years to come, most of these startups will have lost a lot of investor money and will have nothing to show for it. In the Chainium platform, such incidences are prevented by the communication that is there between business owners and the investors. The right value the company deserves can be discussed instead of the speculative high values being given to start ups in the current system. The Chainium platform would be the best solution necessary for preventing the rise of another bubble in financial markets.

The Chainium platform will host a lot of sensitive data and transaction. Dealing with stocks is a risky endeavor as there are parties who are hell-bent in gaining profit even if it is in the wrong ways. The current centralized system is prone to attacks as it houses a lot of data which is lucrative in the black market. It is also prone to collapse in case of system failure. Its centralization makes it such that one system failure affects the entire system and could cripple equity markets until normalcy has been restored. The Chainium system offers a decentralized system that will provide security to its system and prevent any future collapse of its equity market. Data will be spread across its network of computers such that when one is attacked, the market can still be operational. Chainium understands the high risk its system is prone to and will make security its top priority. Chainium will out systems in place to ensure that all their facilities are as secure as possible. Its physical offices will have CCTV cameras and other modern security features that will make them secure against any physical attack. Chainium will also conduct training for its staff. It believes that security should start right from the employee therefore Chainium will train them to detect any possible security threats. There are a number of other security features that Chainium will provide which are detailed in the following link https://www.chainium.io/uploads/files/Chainium-Security-Whitepaper-v15_2.pdf.

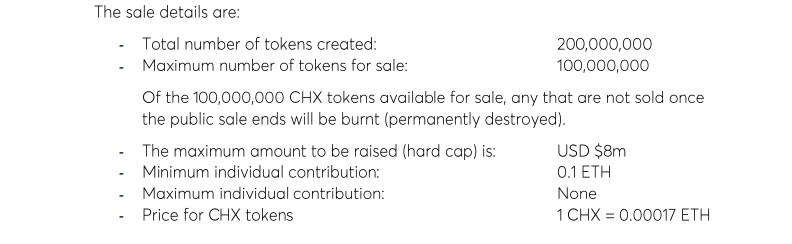

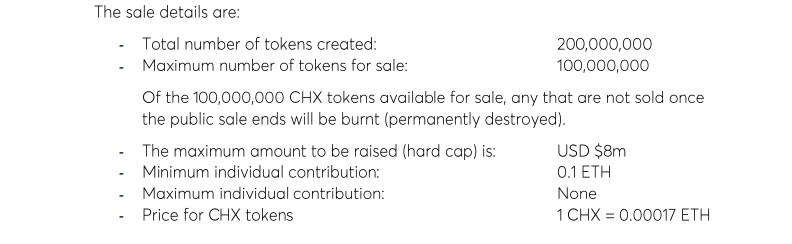

Chainium will offer tokens known as CHX. These are utility tokens that will be solely used within the Chainium platform. CHX will be useful in reward Chainium community members whenever they refer others to join the program. Other rewards will also be awarded through CHX depending on how the CHX community members use the platform. There will be awards for successfully running a capital raising offer in the platform and many more. The tokens obtained can then be used to pay for services that Chainium will offer. Chainium will be able to give business advice and investment advice to any of its members based on the data they collected on the Chainium platform. Investors will be directed to companies that are highly likely to be profitable and business owners will be linked with investors that are seeking a particular type of business. These services will be offered at a cost that is payable through the CHX. Business owners will also be required to have CHX in a lock up within its offer that will last as long as their equity exists. The CHX will need to be purchased during Chainium’s crowd sale and so they will act as a source of security to investors. Locking up CHX to a company’s equity shows the level of commitment they have and the assurance that they will not leave the platform.

Chainium will transform equity markets through its application of blockchain. They will become more transparent and convenient to use. More investors will be attracted by the model of this platform due to the security and transparency it creates. Its ability to avert or reduce the damage caused by financial crisis will be vital for the years to come. Chainium seeks to develop this platform and will be hosting ICO events to help raise the capital required to build this platform. The pre ICO sale was already conducted in late 2017 and the public ICO is set for March 2018. CHX can be purchased through cryptocurrency or fiat. If you have faith that this platform will be the foundation for the revolution in the equity markets and you want to take part in building it, you can use the following links to participate in the token sale.

Website- https://www.chainium.io/

Whitepaper- https://www.chainium.io/uploads/files/Chainium-Business-Whitepaper-v3.pdf

Facebook- https://www.facebook.com/chainium.io/

Twitter- https://twitter.com/ChainiumIO

Medium- https://medium.com/@chainium

Telegram- https://telegram.me/chainium

In as much as there have been positive changes in the stock market, there are some key areas that could still be changed to make the stock markets even more efficient. The system that is currently being used is an okay system but it could be better. What also fuels the need for this change is the fact that the current generation is not keen on stock markets as the previous one was. To them stock markets are not as transparent as they would want them to be and would rather invest in businesses directly rather than this channel. Recent studies have also shown a decline in the number of companies that go public since the early 2000’s. The financial crisis that was seen in 2008 is also an indicator that we need a new system that is able to show signs of a collapse early enough so that we may be able to come up with measures that will prevent them from happening.

The innovation that is blockchain can provide solutions to the problems facing the stock market. One of the key things that blockchain is praised for is the security it is able to offer. Blockchain records data in a ledger like format. Data can only be added in once a number of random users within a particular blockchain accept this data as legitimate. The data is stored across a network of computers. Blockchain decentralizes the data it has such that affecting one computer in the network will have no effect on the data stored across its decentralized network. Any change of data is also recorded such that manipulating data becomes very difficult as all involved parties will note the change and a record will be kept showing who tried to change the data. Chainium is basing its system on blockchain. It will use the Ethereum blockchain. The Ethereum blockchain has a feature that allows developers to create smart contracts. Smart contracts are a set of agreements set by two or more trading parties where requirements are placed concerning the transactions. The trade can only take place once all parties meet this requirement. Blockchain technology has been applied in many fields and the stock market could prove to be the most important one yet.

Chainium wants to return the stock market back to its basics, the need to raise capital for business and provide a platform for investments. Chainium is seeking to create a platform where companies seeking to raise capital and investors seeking for good opportunities to invest in are brought together. In its platform, these two parties will be trading on a one on one basis; the business owner and the prospective investor. Chainium took this approach as many businesses in the 21st century are opting for other forms of investments rather than going public. There are so many requirements and bureaucracies that are involved when a company decides to go public. It is even harder for smaller companies as they may not have the capital itself needed to go public. They therefore opt for angel investors, venture capitalists or borrow loans from their friends and family as it is much simpler in this way. The disadvantage with opting for any of these options is the fact that business owners will have to bend to the demands of the investor which may sometimes hurt their business plans. With the Chainium system, business owners will be linked directly to investors who are willing to invest in viable opportunities. The great thing about this system is that it will work similarly to an IPO in that the power of negotiation lies with the business owner. The business owner will only accept offers that will help the business grow.

Furthermore, a one on one system will also eliminate the use of middlemen in equity markets. In as much as they are effective, they also come with cost implications for both trading parties. Companies and investors have also suffered in the hands of some of these stock brokers as they collude with other parties to swindle fortunes out of their stocks. Insider trading and other types of fraud will have been eradicated using this system. There is also the potential of saving a huge amount of money that would have otherwise been used in servicing frictional costs.

The dangers that come with speculation can also be done away with using the Chainium platform. The 2008 economic recession that hit the world was caused by a lot of speculation within different market sectors. Speculators were predicting growth in the housing industry which led most investors to invest their money in numerous housing companies. Developers also took bank loans to develop housing complexes as the people took more loans to buy houses and cars. This speculation led to a chain of loans that the analysts predicted the economy could not sustain and when these signs started showing investors started pulling out their money. Loans were left unpaid as investors scrambled out of the market opting to save some money while they still can. The rush in selling of stocks caused a collapse in prices which greatly affected the stock market. This happened in the United States but since investors come from various parts of the world and the US markets supports many economies, the effect was felt worldwide. This happened because the current equity market structure is not as transparent as it should be. Chainium is offering transparency through its platform. The personal approach to business will help investors and business owners discuss growth and challenges facing growth which could help settle investors in case of any circulating rumors. Business owners will have the chance to assure investors of their plans to avert any foreseeable crisis. This will keep investors calm and willing to keep their money invested in these stocks.

The problem with business valuation can be done away with in the Chainium platform. The 2000’s and 2010’s have seen quite the boom in technological companies and most successful ones have gone public; the values of companies such as Facebook or amazon are investor dreams. These are the type of companies anyone would want to put their money into. The problem that arose with the popularity of tech companies is their over valuation. Many startups are coming up and going public. Investors pump in a lot of money into these startups hoping that they will bear even half the fruit that Facebook or amazon bore. These startups however offer little innovation. Most of the niches they occupy have inadequate market numbers that investors would want to see. The existing tech companies also end up adopting their innovation thus making them obsolete. The best-case scenarios for startups are being absorbed by the established tech companies which would be good for investors. Analysts are speculating that in a few years to come, most of these startups will have lost a lot of investor money and will have nothing to show for it. In the Chainium platform, such incidences are prevented by the communication that is there between business owners and the investors. The right value the company deserves can be discussed instead of the speculative high values being given to start ups in the current system. The Chainium platform would be the best solution necessary for preventing the rise of another bubble in financial markets.

The Chainium platform will host a lot of sensitive data and transaction. Dealing with stocks is a risky endeavor as there are parties who are hell-bent in gaining profit even if it is in the wrong ways. The current centralized system is prone to attacks as it houses a lot of data which is lucrative in the black market. It is also prone to collapse in case of system failure. Its centralization makes it such that one system failure affects the entire system and could cripple equity markets until normalcy has been restored. The Chainium system offers a decentralized system that will provide security to its system and prevent any future collapse of its equity market. Data will be spread across its network of computers such that when one is attacked, the market can still be operational. Chainium understands the high risk its system is prone to and will make security its top priority. Chainium will out systems in place to ensure that all their facilities are as secure as possible. Its physical offices will have CCTV cameras and other modern security features that will make them secure against any physical attack. Chainium will also conduct training for its staff. It believes that security should start right from the employee therefore Chainium will train them to detect any possible security threats. There are a number of other security features that Chainium will provide which are detailed in the following link https://www.chainium.io/uploads/files/Chainium-Security-Whitepaper-v15_2.pdf.

Chainium will offer tokens known as CHX. These are utility tokens that will be solely used within the Chainium platform. CHX will be useful in reward Chainium community members whenever they refer others to join the program. Other rewards will also be awarded through CHX depending on how the CHX community members use the platform. There will be awards for successfully running a capital raising offer in the platform and many more. The tokens obtained can then be used to pay for services that Chainium will offer. Chainium will be able to give business advice and investment advice to any of its members based on the data they collected on the Chainium platform. Investors will be directed to companies that are highly likely to be profitable and business owners will be linked with investors that are seeking a particular type of business. These services will be offered at a cost that is payable through the CHX. Business owners will also be required to have CHX in a lock up within its offer that will last as long as their equity exists. The CHX will need to be purchased during Chainium’s crowd sale and so they will act as a source of security to investors. Locking up CHX to a company’s equity shows the level of commitment they have and the assurance that they will not leave the platform.

Chainium will transform equity markets through its application of blockchain. They will become more transparent and convenient to use. More investors will be attracted by the model of this platform due to the security and transparency it creates. Its ability to avert or reduce the damage caused by financial crisis will be vital for the years to come. Chainium seeks to develop this platform and will be hosting ICO events to help raise the capital required to build this platform. The pre ICO sale was already conducted in late 2017 and the public ICO is set for March 2018. CHX can be purchased through cryptocurrency or fiat. If you have faith that this platform will be the foundation for the revolution in the equity markets and you want to take part in building it, you can use the following links to participate in the token sale.

Website- https://www.chainium.io/

Whitepaper- https://www.chainium.io/uploads/files/Chainium-Business-Whitepaper-v3.pdf

Facebook- https://www.facebook.com/chainium.io/

Twitter- https://twitter.com/ChainiumIO

Medium- https://medium.com/@chainium

Telegram- https://telegram.me/chainium

Comments

Post a Comment